No One Owns the Tradeoff

The Real Reason Planning Transformations Fail

It’s Not bad data. It’s Not the Tool. It’s Decision Governance.

Every company says they want better planning.

They invest in IBP. They upgrade ERP. They implement demand sensing, inventory optimization, supply optimization, and so on. They hire data scientists. They add dashboards.

And yet…

Service is volatile. Margins are unpredictable. Inventory swings wildly. And every disruption turns into a negotiation.

Why?

Because the real failure isn’t in forecasting or optimization.

It’s in decision governance.

Planning Doesn’t Break Because of Math

It Breaks Because of Friction.

Over the last several years, I’ve seen the same patterns repeat across industries — semiconductors, industrials, high-tech, CPG.

Different products. Different supply chains. Same friction.

Let’s call it what it is:

Cross-team decision friction.

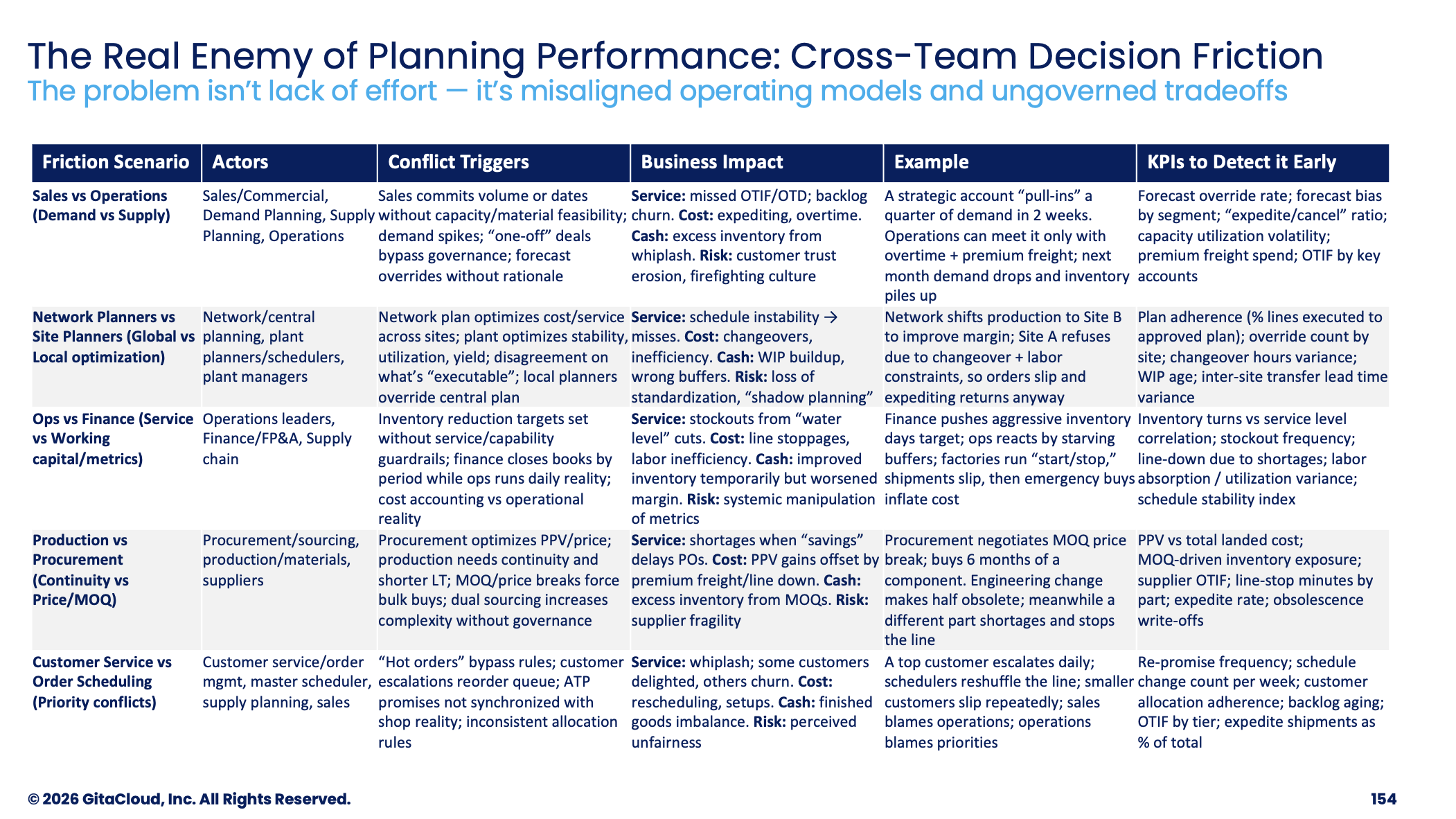

Here are the recurring archetypes.

1. Sales vs. Operations

Demand commits without supply feasibility

Sales lands a major deal. Operations learns about it after the promise is made.

Result?

Overtime

Premium freight

Schedule instability

Next month demand collapse

Excess inventory

And then the post-mortem:

“Forecast was wrong.”

No. The forecast wasn’t the root cause.

The decision rights were unclear.

Who approves large pull-ins? Who validates capacity feasibility? What triggers executive escalation?

If those rules aren’t institutionalized, every large order becomes a firefight.

2. Network Planners vs. Site Planners

Global optimization vs. local execution reality

Central planning optimizes cost and service across the network. They optimize for lean inventories to improve working capital.

A plant planner sees:

Changeover constraints

Labor skill gaps

Maintenance downtime

Yield issues

Central says: “Run this mix.”

Plant says: “That’s not executable.”

Orders slip. Expediting happens anyway.

What’s missing?

Not analytics.

Governance.

Who owns tradeoffs between margin and schedule stability? When can a site override a central plan? What is the escalation path?

Without clarity, shadow planning emerges.

And shadow planning destroys trust.

3. Operations vs. Finance

Service vs. working capital

Finance pushes inventory reduction targets.

Operations protects buffers to avoid line stoppages.

Quarter-end hits. Inventory drops. Next month shortages spike.

Metrics are optimized.

Outcomes are not.

The problem isn’t KPIs.

It’s that no one owns the tradeoff between:

Service

Margin

Cash

When those metrics sit in different silos, friction is inevitable.

4. Procurement vs. Production

PPV savings that create bigger costs

Procurement negotiates a lower price based on MOQ.

Six months of inventory arrives.

Engineering changes a part.

Half becomes obsolete.

PPV looks great.

Total landed cost doesn’t.

Why?

Because procurement was measured on price, not risk-adjusted service impact.

There was no decision model connecting:

MOQ strategy

Supply risk

Obsolescence exposure

Expedite cost

Savings were real — but incomplete.

5. Customer Service vs. Scheduling

Hot order chaos

Customer escalates.

Order is reprioritized.

Another order slips.

Another customer escalates.

The cycle continues.

In many organizations, there is:

No formal allocation policy

No controlled expedite lane

No single priority owner per horizon

So every exception becomes political.

And politics is not a scalable planning architecture.

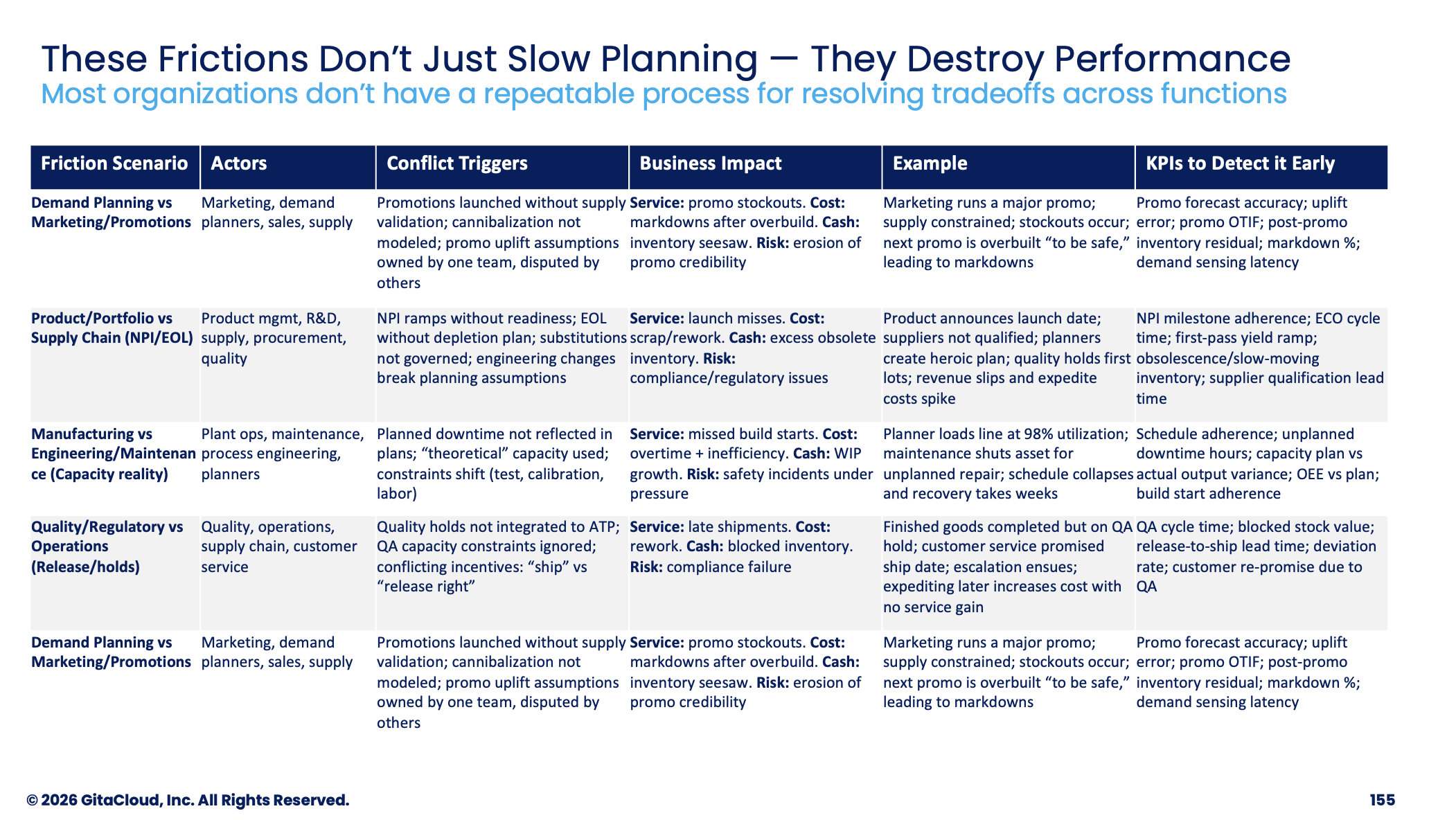

6. Promotions & Portfolio Surprises

Supply reacts to marketing, not the other way around

A promotion launches without supply validation.

Stockouts occur.

Next promotion is overbuilt “to be safe.”

Markdowns follow.

The issue isn’t promotional forecasting.

It’s that promo/NPI decisions were made outside the planning cadence.

If product, marketing, and supply do not operate under shared decision governance — aligned to one calendar, one escalation logic, one risk model — volatility compounds.

7. Data Dysfunction

“The data is stale, if not outright wrong, so planners compensate.”

Master data mismatches.

Lead times, shrinkage factors, MOQ data is stale.

Hierarchy definitions don’t align.

Planners create offline files.

Manual overrides proliferate.

Trust erodes.

And again, the root cause isn’t data quality alone.

It’s ownership.

Who owns lead time accuracy? What SLA governs master data changes? What lead time variance threshold blocks planning runs?

Without embedded data governance in planning cadence, “self-healing” never happens.

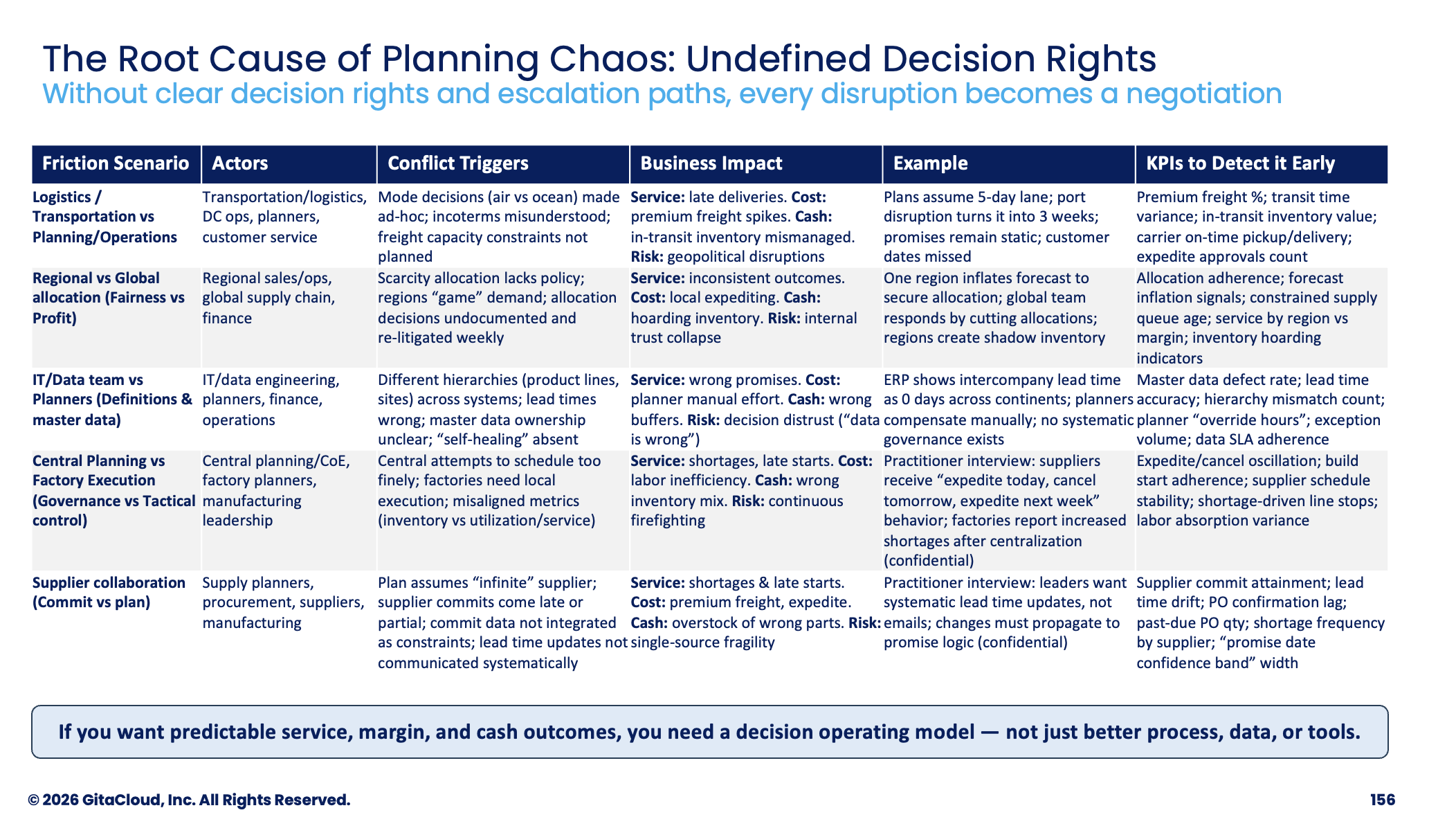

Here’s the Hard Truth

Most planning transformations focus on:

Process redesign

Tool implementation

KPI harmonization

Data integration

All important.

But insufficient.

Because friction doesn’t disappear when you add dashboards.

It disappears when you institutionalize decision rights.

Planning Is a Decision Operating Model

Let’s elevate the conversation.

Enterprise planning is not:

A forecast or plan.

A monthly S&OP meeting.

A system configuration.

A slide deck on transformation.

It is a decision operating model.

And that model must answer five fundamental questions:

Who owns the enterprise tradeoff? Network vs site? Service vs cash? Cost vs risk?

What are the escalation triggers? Variance thresholds. Capacity violations. Allocation conflicts.

What are the guardrails? Service floor. Margin floor. Working capital ceiling.

What is the exception governance path? Who approves deviation? Based on what data? Within what time frame?

Is every material decision auditable? Or does it live in email and tribal memory? How do we learn from past decisions?

Without these, even the best planning math collapses into negotiation.

What Winning Organizations Do Differently

The companies that stabilize service, margin, and cash don’t just implement IBP.

They redesign decision governance.

Here’s what that looks like in practice.

1. Define Enterprise vs Local Ownership Explicitly

Plant planners report solid-line to plant leadership for execution.

But dotted-line to a central planning CoE for standards and methods.

Central planning cannot arbitrarily override site schedules.

Sites cannot ignore enterprise inventory policy guardrails.

Both operate within defined authority bands.

Governance without control theft.

2. Create Structured Exception Councils

Example: an Order Prioritization Council inside weekly MPS cadence.

Rules:

Customer service cannot override without documented business case.

Cost-to-serve impact must be visible.

Escalation thresholds pre-defined.

Hot orders move from political escalation to structured review.

3. Optimize Total Outcome, Not Functional KPIs

Procurement accountable not just for PPV — but for:

Total expedite cost

Shortage frequency

Supplier commit reliability

Finance accountable not just for working capital in inventory — but also for:

Service stability impact to future revenue

Shortage-driven margin erosion

Metrics become contextual, not isolated.

4. Institutionalize Supplier Commit Integration

Plans assume infinite supply.

Reality rarely cooperates.

Mature organizations:

Integrate supplier commits as constraints

Track lead time drift

Escalate based on commit attainment

Balance forecast accuracy with procurement churn

Collaboration becomes structured, not reactive.

5. Embed Data Governance into Planning Cadence

Create Data Product Owners for:

Lead time

OEE

Shrinkage

HTS Codes and Tariff Rates

Publish weekly data fitness scorecards.

Block planning changes when data falls below threshold, e.g., mean observed lead time across last 6 months of purchase orders vs. lead time in item-supplier master data.

Data governance is not an IT project.

It is a planning discipline.

Why This Matters Now

Volatility is not going away.

Tariffs. Geopolitics. Capacity shocks. Demand swings. Portfolio churn.

In volatile environments, friction multiplies.

And when friction multiplies, margins erode faster than most CFOs expect.

The organizations that win will not be those with:

The prettiest dashboards

The most advanced AI models

The most buzzwords in their transformation program

They will be those that can convert cross-functional conflict into:

Fast decisions

Auditable decisions

Repeatable decisions

Enterprise-aligned decisions

A Final Provocation

If I walked into your organization today and asked:

Who has final authority over service vs margin tradeoffs?

At what threshold does a site escalate to enterprise?

Who can override allocation logic?

What master data is stale and impacts planning quality?

Which decisions are systematically logged vs informally negotiated?

Would you have clear, written answers?

Or would it depend on who’s in the room?

Because that answer tells you everything about your planning maturity.

Bottom Line

Planning friction is not a capability problem.

It is a governance problem.

Companies that win define decision owners, escalation thresholds, and structured decision flows that turn cross-functional conflict into fast, auditable enterprise decisions.

If you want predictable service, margin, and cash outcomes —

You need a decision operating model.

Not just better process, data, or tools.

If this resonates, I’d love to hear:

Where does friction show up most in your organization — and how is it currently resolved?

Because that conversation is where real transformation begins.

P.S. If this resonates, here’s a quick diagnostic: below are common planning friction scenarios we see across global supply chains. See which ones show up in your organization — and which ones you keep re-litigating every week.